Digital cash and digital ID

A dangerous step towards government overreach

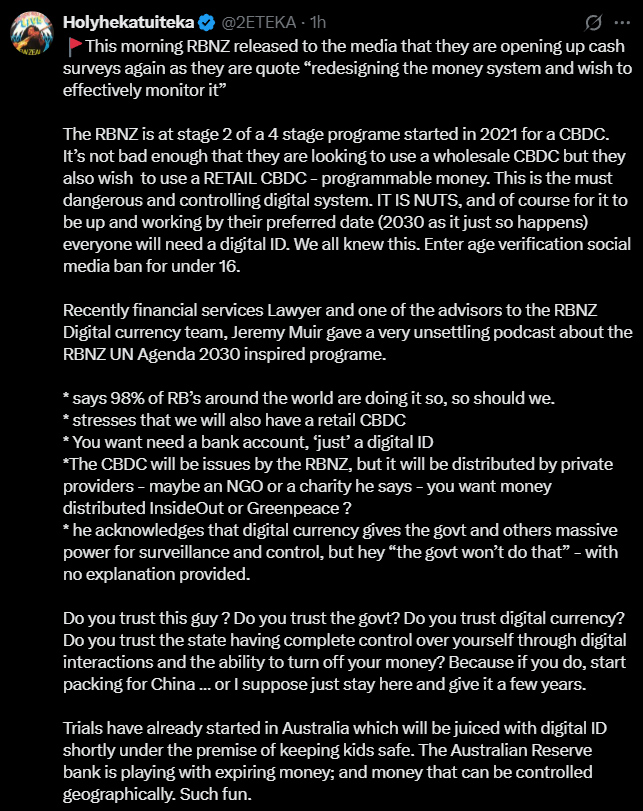

The Reserve Bank of New Zealand (RBNZ) is continuing to explore the introduction of “digital cash”, a central bank issued form of currency that would exist purely online. If tied to a digital ID system, this proposal could give the government unprecedented control over how, where, and when New Zealanders use their money.

While the RBNZ insists this would complement physical cash, not replace it, the reality is that once digital cash infrastructure is in place, physical money will likely be phased out in the name of “efficiency” or “security”. What is left is a programmable currency fully controlled by the state.

That is precisely the problem.

If digital cash is linked to a digital ID, it becomes programmable. That means authorities could restrict how your funds are used. They could impose conditions, expiry dates, or spending limits. In theory, they could freeze your access entirely, whether due to an administrative issue, a protest you attended, or simply falling out of favour with the political class.

Sound far-fetched? It is already being discussed globally. Central Bank Digital Currencies (CBDCs) are being designed with the ability to set rules around when and how money can be spent. In places like China, it is already happening. The fear is that New Zealand could follow suit, under the radar and with limited public awareness.

Digital cash creates a data trail. Every purchase, payment, or donation would be recorded and stored. Even if the RBNZ claims it would not access this data, the infrastructure would exist, and future governments could expand its use. What begins as convenience can easily become surveillance.

According to the RBNZ’s own public consultation, nearly half of respondents raised concerns about privacy. Some feared financial censorship or monitoring of personal transactions. These are valid, serious issues, yet they appear to have been brushed aside in the bank’s official reports.

Critics of digital ID and digital cash systems are often labelled alarmists. But concerns over CBDCs are not new, nor are they confined to fringe voices. Experts from the Physicians & Scientists for Global Responsibility have warned that these systems create "dark infrastructure" that can be used to control populations without full democratic oversight.

Think vaccine passes, but for your money.

Even without the threat of government overreach, a digital-only system creates problems. Vulnerable people without access to smartphones or the internet could be excluded. Cyber attacks, outages or technical errors could lock people out of their own money. What happens in a natural disaster or a power cut when you cannot access the funds in your account?